CAPITAL AND REVENUE:

Why is the distinction between capital and revenue important?

The concepts of capital and revenue are important for the correct determination of accounting profit for a period and the recognition of business assets at the end of that period.

The difference affects the measurement of profit over several accounting periods.

Capital is defined by economists as those assets used in the production of goods and services for the production of assets.

In accounting, on the other hand, the capital of a business is increased by a share of periodic income that has not been consumed by the owner.

The relation of capital and revenue is between a tree and its fruits. It is the tree that produces fruit, and it is the fruit that can be consumed.

If the tree is taken care of, it will produce more fruit, on the contrary, if the tree is destroyed, there will not be more fruit.

Similarly, revenue originates from capital and capital is the source of revenue. Capital is invested by a person in the business so that it can produce revenue.

In addition, as the fruit may give rise to another new tree, various revenues may also produce new capital further.

Capital can be brought into the business by a person in various forms — cash or in kind. When capital is purchased as cash, it is spent on various items of assets that make the business concern.

Thus, the firm's capital is represented by its inventory of assets.

The capital of a business can be increased in two ways:

- When the owner brings more capital to the business; And/or

- When the owner does not consume the entire periodic income.

When the owner brings forward capital to his business, the amount is credited to the capital account.

Similarly, the net income for a period is credited to the capital account, and if its picture is less than that income, the capital increases by the difference.

The difference between two-term revenue and receipts should be carefully distinguished.

Receipts are money inflows into the business, while revenue is the total exchange value received for goods and services provided to customers.

Capital expenditure and Revenue expenditure and receipts with examples:

What is the Capital Expenditures meaning and Revenue Expenditures meaning explain with examples?

Capital Expenditure meaning:

Capital Expenditure is the outflow of funds to acquire an asset that will benefit the business for more than one accounting period.

Capital Expenditures occur when an asset or service is acquired or the improvement of real estate is affected.

These assets are expected to provide profit to the business in more than one accounting period and are not intended for resale in the normal course of business.

In short, it is expenditure on assets that are not written off completely against income in the accounting period in which it is incurred.

Revenue Expenditure meaning:

Revenue Expenditure in accounting is the outflow of money to meet the running expenses of a business and will be of profit only for the current period.

Revenue Expenditure in accounting is incurred to carry on the normal course of business or to maintain capital assets in good condition.

It can be stated here that expenditure is not required, payment in cash to someone is not necessary - this can be done by cash, by an exchange of another asset, or by increasing a liability.

An increase in expenditure and recognition of expenditure are separate phenomena.

An increase in expenditure refers to the receipt of goods and services, while expenditure recognition is a matter of deciding whether the expenditure is of a capital or revenue nature.

For example, the purchase of an asset is a capital expenditure but a depreciation charge against profit is a revenue expenditure incurred on the entire life of that property.

Most capital expenditures incurred by a business become revenue expenditure in accounting.

On the application of periodicity, contingency, and matching concepts, accountants identify all revenue expenditures for a given period to gain benefits.

An expense that cannot be recognized in a particular accounting period is considered to be of a capital nature.

The accounting treatment of capital expenditures and revenue expenditure is as under:

Revenue expenditures in accounting are charged as an expense against profit in the year they are incurred or recognized. Capital expenditures in accounting are capitalized added to an asset account.

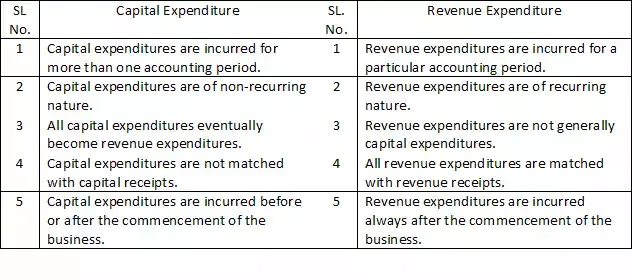

The following are the points of difference between capital expenditures and revenue expenditures:

How do you determine capital expenditures and revenue expenditures in accounting?

Rules for Determining Capital Expenditures in accounting:

An expenditure can be recognized as capital if it is incurred for the following purposes:

Expenses incurred for the purpose of acquiring a long-term asset (useful life exceeds at least one accounting period) for use in business to make a profit and for resale will be treated as Capital Expenditure in accounting.

Capital Expenditures examples: If a second-hand motor car dealer purchases a piece of furniture, with a view to using it in business; This will be a capital expenditure in accounting.

But if he buys second-hand motor cars, it will be a revenue expenditure in accounting as he deals in second-hand motor cars.

When expenditure is incurred to improve the current state of a machine or put an old asset in working conditions, it is recognized as capital expenditure in accounting.

Expenses are capitalized and added to the cost of the asset. Similarly, any expenditure incurred to put the asset in working condition is also capital expenditure in accounting.

Capital Expenditures examples: If a machine buys for Rs.5,00,000 and buys Rs.20,000 as transportation fee and Rs. 40,000 as installation fee, the total cost of the machine is up to Rs.5,60,000. She comes.

Similarly, examples of Capital Expenditure if a building is purchased for Rs.1, 00,000, and Rs.5, 000 is spent on registration and stamp duty, the capital expenditure on the building is Rs.1, 05,000.

If an expenditure is incurred, the capital will be considered to be of nature to increase the earnings of the business.

For example, expenditure to relocate the factory for an easy supply of raw materials. Here, the cost of such a transfer would be a capital expenditure in accounting.

Initial expenses incurred before the commencement of business are considered capital expenditure in accounting. For example, legal fees for brokerage are paid to a company or brokerage, or articles of commission paid to raise commission, or commission paid to raise capital.

Thus, a useful way of recognizing an expense as capital expenditure in accounting is that the business will be something that qualifies as an asset at the end of the accounting period.

What are the examples of Capital Expenditure?

Rules of determining Revenue Expenditure in accounting:

Any expenditure that cannot be identified as a capital expenditure can be called Revenue Expenditure.

Revenue Expenditure temporarily affects the business's ability to make only a profit.

An expense is recognized as revenue when it is for the following purposes:-

Expenses for the day-to-day conduct of the business, the benefit of which lasts less than one year.

Examples of Revenue Expenditures are workers' wages, interest on borrowed capital, rent, sales expenses, and so on.

Expenditure on consumables, on goods and services for resale, either in their original or imported form.

Examples of Revenue Expenditures are the purchase of raw materials, office stationery, and the like. At the end of the year, some revenue items (stock, stationery, etc.) may still be on hand.

These are generally passed for the following year through which they were acquired in the previous year.

Expenses for maintaining immovable properties in working order. For example, repair, refurbishment, and depreciation.

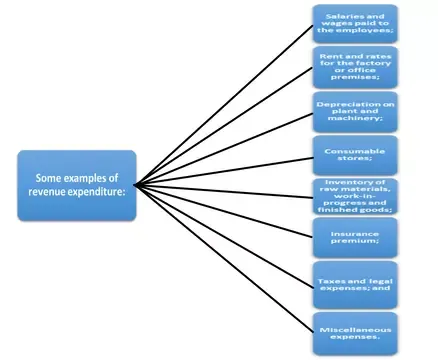

What are the examples of Revenue Expenditure?

Replacement of Fixed Assets:

The above rules of capital expenditures and revenue expenditures are not good when one existing asset is changed for another.

If a property is replaced with the same king as the property, the expenditure incurred is treated as revenue expenditure in accounting.

For example, if a set of weighing machines in a shop goes bad and is replaced by a similar set, the cost of a replacement should be treated as revenue expenditure in accounting and put into profit and loss account. needed.

However, if an asset is replaced by an asset that is better than the previous one, the expense is partly capital and partly revenue.

For example, if a manual typewriter costs Rs. 5,000, it is replaced with an electronic typewriter, which costs Rs 15,000, then there will be a revenue expenditure in the accounting of 5,000 and the additional value of the new typewriter over the old typewriter, Rs. .10, 000 will be an item of capital expenditure in accounting.

Deferred Revenue Expenditure meaning and examples:

Deferred revenue expenditures represent certain types of assets whose uses do not expire in the year of their occurrence but usually cease in the near future.

This type of expense is carried forward and written off in future accounting periods.

Sometimes, we expend some revenue but it eventually becomes a capital asset (usually of an intangible nature).

If one makes adequate repairs to the existing building, the deterioration of the premises can be avoided.

We can appoint our own employees to do that work and pay them at the prevailing wage rate, which is of a revenue nature.

If this expenditure is treated as revenue expenditure and the current year's profit is charged along with these expenses, then we should absorb the current year as a whole, which will be availed for several years of accounting years.

To overcome this difficulty, the entire expenditure is capitalized and added to the asset account.

Deferred Revenue Expenditure example is an insurance policy. A business can pay insurance premiums in advance, say for a period of 3 years. The right does not expire in the accounting period in which it is paid but will expire within a short period of time (3 years).

Only a portion of the total premium paid should be treated as revenue expenditure (part related to the current period) and the remainder should be written off as an asset in subsequent years.

Capital receipts and Revenue receipts:

What are capital receipts and revenue receipts?

A receipt of money may be of a capital or revenue nature. A clear distinction, therefore, should be made between Capital receipts and Revenue receipts.

Capital Receipts meaning:

A receipt of money is considered as a capital receipt when a contribution is made by the proprietor towards the capital of the business or a contribution of capital to the business by someone outside the business.

Capital receipts do not have any effect on the profits earned or losses incurred during the course of a year.

Additional capital introduced by the proprietor; by partners, in case of partnership firm, by issuing fresh shares, in case of a company; and selling assets, previously not intended for resale.

Revenue Receipts meaning:

A receipt of money is considered as revenue receipt when it is received from customers for goods supplied or fees received for services, rendered in the ordinary course of business, which is a result of the firm’s activity in the current period.

Receipts of money in the revenue nature increased the profits or decreased the losses of a business and must be set against the revenue expenses in order to ascertain the profit for the period.

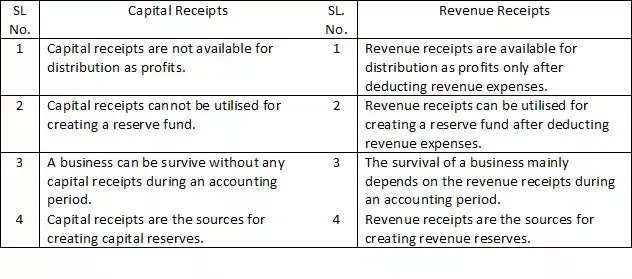

The following are the points of difference between capital receipts and revenue receipts:

Capital Profits and Revenue Profits:

What are capital profits and revenue profits?

Capital gains arising from: -

Treatment of capital profit and revenue profit:-

Capital losses and Revenue losses:

What are capital loss and revenue loss?

While deriving profit, revenue losses are distinguished from capital losses in the same way that revenue gains are separated from capital profits.

A normal course of business results in a revenue loss, sold to the trader at a price below its selling price or the price of goods sold or where the present value of the inventory falls.

Capital losses may be less than the sale of the property, other than inventory for less than the written price, or as a result of use or sale (flood, fire, etc.) or in addition to the elimination of assets or in relation to the increase of capital.

To consider trading (issue of shares at a discount) or settlement of liabilities in excess of its book value (issued in equal but redeemed at a premium).

The treatment of capital losses is similar to capital gains. Capital losses from the sale of fixed assets generally appear in the profit and loss account (deducted from net profit).

But other capital losses are adjusted against the credit balance of capital profits. Where there is considerable loss of capital, treatment is different.

Their losses are usually shown on the balance sheet as fictitious assets and the common practice is that the amount is completely depleted for several accounting years as a charge against revenue gains.

Comments

Post a Comment

If you have any doubts, Please let me know