Characteristics of Depreciation:

In this chapter describing characteristics and different methods of Depreciation:--

What are the characteristics of depreciation?

- It is charged against profit.

- It indicates diminution in service potential.

- It is an estimated loss of the value of an asset. It is not an actual loss.

- It depends upon different assumptions, like the effective life and a residual value of an asset.

- It is a process of allocation and not of valuation.

- It arises mainly from an internal cause like wear and tear or depletion of an asset. But it is treated as any expense charged against profit like rent, salary, etc., which arise due to an external transaction.

- Depreciation on any particular asset is restricted to the working life of the asset.

What is amortization in depreciation accounting?

It is charged on tangible fixed assets. It is not charged on any current asset. For allocating the costs of intangible fixed assets like goodwill, etc., a certain amount of their total costs may be charged against periodic revenues. This is known as amortization. Depreciation includes the amortization of intangible assets whose effective lives are pre-estimated. Intangible assets render benefits but they do not have any physical existence, their economic-value are perceived to exist. Amortization or Writing Off such assets is made to account for the deterioration of their economic values.

What is depletion and obsolescence in depreciation?

Depletion means gradual exhaustion of physical resources due to extraction etc, as found in mines, quarries, etc.

Obsolescence means a major deterioration in the utility of an asset due to (a) innovation of improved substitutes or techniques (b) drastic fall in the demand of a product arising through a change in market conditions, tastes, or fashions; and (c) usefulness lost and inability arising to cope with the increased scale of operation.

What are the depreciation methods and how it's calculated?

There are different concepts about the nature of depreciation. Moreover, the nature of all fixed assets cannot be the same. As a result, different methods are found to exist for charging depreciation. A board classification of the depreciation methods with examples may be summarised as follows:

Capital/ Source of Fund:

- Sinking Fund Method

- Annuity Method

- Insurance Policy Method

Time Base:

- Fixed Instalment Method

- Reducing Balance Method

- Sum of Years' Digit Method

- Double Declining Method

Use Base:

- Working Hours Method

- Mileage Method

- Depletion Unit Method

- service Hours Method

Price Base:

- Revaluation Method

- Repairs Provision Method

There are different depreciation methods with examples describing below:

1) Sinking Fund Method:

Annual depreciation is considered as a source of providing the replacement cost of an asset. It becomes a means of maintaining capital.

D = Depreciation

C = cost of the asset

i = Rate of Depreciation

n = Life of the asset

Journal Entries under the Sinking Fund method: At the end of the first year:

1.(a) Profit & Loss A/c--------Dr.

To Depreciation A/c

Or Profit & Loss A/c--------Dr.

To Sinking Fund A/c

2. Sinking Fund Investment A/c-----------Dr.

To Bank A/c

(invested amount)

At the end of second/subsequent years:

1. Profit & Loss A/c---------Dr.

To, Sinking Fund A/c

(annual contribution)

2. Bank A/c----------Dr.

To Interest on Investment A/c

(annual interest)

3. Interest on Investment A/c---------Dr.

To Sinking Fund A/c

(interest transferred)

4. Sinking Fund Investment A/c---------Dr.

To Bank A/c

[amt. invested usually = annual contribution + annual interest]

When the working life of the asset ends (1),(2), & (3) same as above; (4) not made in the last year

5. Bank A/c---------Dr.

To Sinking Fund Investment A/c

(Investment sold out)

6. Sinking Fund Investment A/c--------Dr.

To Sinking Fund A/c

(profit on Sale)

or Sinking Fund A/c---------Dr.

To Sinking Fund Investment A/c

(Loss on Sale)

7. Sinking Fun A/c----------Dr.

To Asset A/c

(Asset a/c closed)

Notes:

- No investment is made in the last year as the investment are to be sold out.

- Sinking Fund Account may be called Depreciation Fund Account also. It is to be shown on the liability side of the Balance Sheet.

- Sinking Fund Investments Account may be called Depreciation Fund Investment Account also. It is to be shown on the Asset side of the Balance Sheet. Annual Contribution (charged in lieu of annual depreciation) = Original Cost * Present Value of Re. 1 at a given interest rate

Illustration: Cost of an Asset Rs. 40,000, Life: 4 years. Depreciation 10% per annum.

Under the Sinking Fund Method:

Annual Depreciation =

This amount shall be invested at the end of years 1,2 and 3. The amount of investment shall fetch 10% interest p.a. which will lead to an accumulation of Rs. 40,000 at the end of the 4th year.

The amount of Rs. 8,619 shall not be invested at the end of the 4th year.

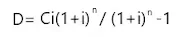

2) Annuity Method:

Cost of an at is considered to be an investment, such investment would earn interest if invested outside the business.

D = Depreciation

C = Cost of the asset

i = Rate of Depreciation

n = Life of the asset

Journal Entries :

1) Depreciation A/c........... Dr.

To Asset A/c

(Being calculated from annuity table)

2) Asset A/c ..........Dr.

To interest A/c

(Being calculated on dismissing value)

3) Profit & Loss A/c

To Depreciation A/c

4) Interest A/c

To Profit & Loss A/c

Under the Annuity Method:

Annual Depreciation:

= 40,000 * 10% * 1.4641/ 1.4641 - 1 = 12,619.

In the case of Annuity Method, the amount of Rs. 12,619 shall not be invested outside the business. It shall have to be taken as a yearly appropriation. The total amount to be appropriated over a period of 4 years = Rs. 12,619 * 4 = Rs. 50,476.

Cost of Capital = Total Appropriation - actual Cost of the Asset = Rs. 50,476- 40,000 = Rs. 10,476.

3) Insurance Policy Method:

- It has a close similarity with the Sinking Fund Method. But, here money is not used for investment in securities. It is used to pay a premium on an Insurance Policy which assures funds necessary for replacement. It may also be called Depreciation Fund Policy Method.

- An insurance policy for an asset is taken on the basis of (a) the specific number of years over which the asset will be used, and (b) the amount that will be required as the replacement cost of the asset.

- At the end of the specific working life of the asset, the policy matures and the Insurance Company pays the amount including a bonus if any.

- Depreciation is substituted by the annual premium on the policy.

Journal Entries: 1st year and subsequent years

1) Profit & Loss A/c----------- Dr.

To Depreciation A/c

(amount of depreciation)

2) Insurance Policy A/c-----------Dr.

To Bank A/c

(Premium paid at the beginning of the year)

At the end of working life of the asset (1) and (2) same as above

3) Bank A/c -----------Dr.

To Insurance Policy A/c

(amount received on maturity of policy)

4) Insurance policy A/c -------------Dr.

To Depreciation Fund A/c

(Profit or bonus received.)

5) Depreciation Fun A/c ------------Dr

To Assets A/c

(for closing these accounts)

6) If the asset is sold out----

Bank A/c----------Dr.

To Asset A/c

4) Fixed/ equal Instalment OR Straight line depreciation Method:

Features:

a) A fixed portion of the cost of a fixed asset located d charged as periodic depreciation.

b) Such depreciation becomes an equal amount in each period.

Depreciation = (V-S)/ n

Where,

V= cost of the Asset

S= Residual value or the expected scrap value

n= estimated life of the asset

5) Reducing/ Diminishing Balance Method OR Written Down Value Method:

Features:

a) Depreciation is calculated at a fixed percentage on the original cost in the first year. But in subsequent years it is calculated at the same percentage on the written down values gradually reducing during the expected working life of the asset.

b) The rate of allocation is instant (usually a fixed percentage) but the amount allocated for every year gradually decreases.

6) Sum of Years Digit Method:

Features:

a) It is a revised form of Reducing Balance Method.

b) Here also the working life of an asset has to be pre-estimated and Total Depreciation is considered as Cost of the Asset (-) Residual or Scrap Value.

c) The amount of annual depreciation goes on decreasing with the use. For calculating depreciation, the denominator becomes the sum of the digits representing the life of the asset. Thus if an asset has a life of 5 years, the denominator should be 1+2+3+4+5 or 15.

Depreciation= (Remaining Life of the Asset * Depreciable Amount)

Sum of the Years' Digit

Where,

Depreciable Amount = Cost of the Asset - Estimated Scrap Value

Sum of the Years' Digit = n(n+)/ 2

n= estimated life of the asset

Example: If an asset co Rs. 50,000. it has a residual value of Rs. 5,000 and working life of 5 years the depreciation will be:--

1st year 5/15 of (50,000-5000) or Rs.15,000;

2nd year 4/15 of (50,000-5,000) or Rs. 12,000;

3rd year 3/15 of (50,000-5000) or Rs. 9,000;

4th year 2/15 of (50,000-5000) or Rs. 6,000;

5th year 1/15 of (50,000-5000) or Rs. 3,000.

7) Double Declining Balance Method:

Features:

a) Depreciation is charged at a fixed rate and it is calculated on the written down value of an asset brought forward on the opening date of an accounting year.

b) The rate of depreciation becomes double of the rate under a fixed instalment method. It may be illustrated as follows:

Orignal Cost of an asset -----Rs. 2,20,000

Scrap Value (Estimated) ----- Rs. 20,000

Working Life (Estimated) ----- Rs. 5 years

Total depreciation Rs. 2,20,000 - Rs. 20,000 = Rs. 2,00,000

Annual Depreciation = Rs. 2,00,000/ 5 = Rs.40,000

Rate of Depreciation under straight Line Method = Rs. 40,000 * 100/ Rs. 2,00,000= 20%

Depreciation under DDB Method = 2 * 20% or 40%

The depreciation will be calculated as:

8) Working Hours Method:

Features:

The Hourly Rate of Depreciation of an asset is calculated as:--

Acquisition Cost - Scrap Value

Estimated Total Working Hours

Annual Depreciation is found out as --- (Hourly Rate of Depreciation * actual working hours rendered by the asset during the year).

It may also be called a Machine Hour Rate where total machine hours of a machine are estimated.

9) Mileage Method:

a) It considers the total distance in miles or kilometres to be run by a vehicle, like a bus, car, lorry, etc.

b) Depreciation per mile/ km =

Cost Price - Scrap Value/ Total miles or kms. expected to be run by the vehicle

c) Annual Depreciation = Depreciation per mile or km * distance covered during the year

10) Depletion Unit Method:

Depreciation Or Depletion per unit =

Cost of acquisition and development cost - Residual value/ Estimated units to be raised or extracted

Annual Depreciation = Depreciation per unit * units produced or extracted during the week.

11) Service Hours Method:

Under this method, the expected service hours or running time is considered as the basis of charging depreciation. For example, a locomotive engine renders effective service for some define running hours. In the case of aircraft flying hours are pre-calculated.

Depreciation per Service Hour = Total Cost - Residual Value/ Total Running time or Service Hours

Annual Depreciation = Rate of depreciation per hour * service hours rendered during the period.

If Depreciation is based on the Market Price of assets:

1) Revaluation Method:

Annual Depreciation is considered to be the reduction in the value of an asset during a year, or Annual Depreciation is the shortfall in the closing value of an asset from its opening value.

2) Repairs Provision Method:

- This method computes depreciation an asset on the basis of (a) the cost of the asset and (b) the estimated total cost of repairs to be needed throughout the working life of the asset.

- The expenses for repairs and renewals do not become the same every year. Rather the amounts spent in different years should be different. The total cost of repairs for an asset throughout its working life is estimated first.

- With total estimated depreciation this estimated cost of repairs is added.

- The result is divided by the working life of the asset to find out annual depreciation. Thus,

[Estimated Total Depreciation = Cost of Acquisition - Scrap Value]

- Whatever may be the actual cost of repairs paid in a year, the Annual Depreciation amount as calculated above is debited to Profit & Loss Account and credited to Provision for Depreciation and Repairs Account. The actual amount paid for repairs is debited to Provision for Depreciation and Repairs account.

- After the expiry of the working life of the asset, the balance of the above-mentioned Provision Account is transferred to the Asset Account.

- Some concerns create Provision for Repairs & Renewal Account separately without including depreciation.

Comments

Post a Comment

If you have any doubts, Please let me know