DOUBLE ENTRY SYSTEM, BOOKS OF PRIME ENTRY, SUBSIDIARY BOOKS:

What is double entry system?

In 1494, Luca Pacioli the Italian mathematician first published his comprehensive treatise on the principles of the Double Entry System. The use of the principles of the double entry system made it possible to record not only cash but also all sorts of Mercantile transactions. Click on to Read More...

Books of Prime Entry Or Books of Original Entry:-

What is Journal in Accounting?

Prior to computerized bookkeeping and accounting, transactions were manually recorded in a Journal in Accounting and then posted to the general ledger.

In addition to the general journal, accountants maintained several other journals, including purchase and sale journals, cash receipts journals, and cash disbursement journals.

Functions of Journal in Accounting:-

There are following Functions of Journal in Accounting are given below:

(i) Analytical work: Each transaction is analyzed in the debit aspect and credit aspect. The Journal of Accounting helps in figuring out how each transaction will affect the business financially.

(ii) Recording function: Accountancy is a business language that helps in recording transactions based on principles. Each such recording entry is supported by a statement that states, a transaction in simple language. The meaning of a statement is to describe. It starts with the word - being a

(iii) Historical work: Journal in Accounting contains a chronological record of transactions for future references.

The Advantages and Limitations of a Journal:-

There are the following Advantages of a Journal given below:

(i) Chronological record: This is when it records transactions. Therefore it is possible to get detailed information from day-to-day.

(ii) Reducing the possibility of errors: The nature of the transaction and its impact on the financial condition of the business is determined by recording and analyzing in the debit and credit aspect.

(iii) Statement: It means the interpretation of the recorded transaction.

(iv) Helps in finalization of accounts: Journal leader is the basis of posting and final test balance. Trial balance helps in the preparation of final accounts.

There is the following Limitation of a Journal given below:

(i) As the number of transactions in the business is large, the journal becomes heavy and voluntary.

(ii) The journal does not provide information on a quick basis.

(iii) As a journal can only be controlled by one person, it does not facilitate the establishment of an internal investigation system.

(iv) Cash transactions are mainly recorded in a separate book called 'Cash Book'. Those transactions are not recorded in the journal.

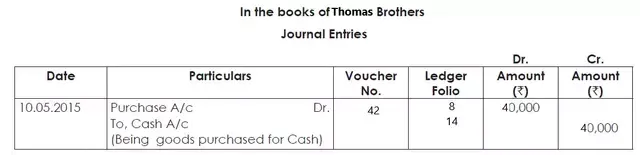

This is the format of Journal

Detailed information regarding the Format of Journal is given below:

(i) Date column: This column contains the transaction date.

(ii) Description: In this column which account is to be debited and which account is to be credited. This statement is also supported by an explanation called narration.

(iii) Voucher Number: The number is written on the voucher for the respective transaction.

(iv) Ledger Folio (L.F.): In this column contains the folio (ie page no.) of the ledger, where the transaction is posted.

(v) Dr. Amount and CR. Amount: It shows the financial value of each transaction. The amount is recorded in both columns as there is an equal and equal credit for each debit.

All columns are filled when entering a transaction except the columns of the transaction folio. It is filled for ledger at the time of posting of the transaction. This process is explained in the previous post.

The given example is based on the Format of Journal:

As per voucher no. 42 of the Thomas Brothers, on 10.05.2015 goods of 40000 were purchased. Cash was paid immediately. Ledger Folios of the Purchase A/c and Cash A/c are 8 and 14 respectively. Journal entry of the above transaction is given below:

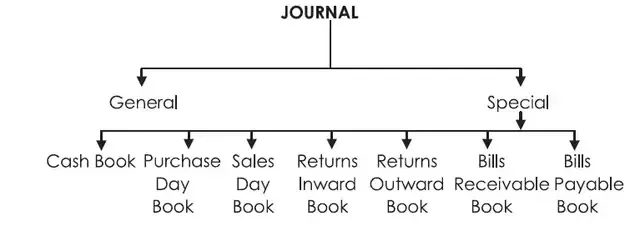

Sub-division of Journal:

Journal is divided into two types -(i) General Journal and (ii) Special Journal.

(i) General Journal in Accounting:

• General Journal is a book of chronological records of transactions.

• General Journal book records transactions that occur so frequently that they do not warrant the establishment of specialized journals.

Examples of such entries: (i) opening entries (ii) closing entries (iii) rectification of errors.

This is the format of General Journal

L.F .: Laser Folio

Dr: debit

Cr: Credit

The recording of transactions in this book is called journalism and the record of transactions is known as a journal entry.

(ii) Special Journal in Accounting:

Special Journal in Accounting is sub-divided into Cash Book, Purchase Day Book, Sales Day Book, Returns Inward Book, Returns Outward Book, Bills Receivable Book, and Bills Payable Book. These books are called subsidiary books.

Importance of Subdivision of Journal in Accounting:-

When the number of transactions is large, it is practically not possible to record all transactions through a journal due to the following limitations of the journal:

(i) For a system of recording all transactions in a journal, (a) the account name has to be written, in which the transaction occurs multiple times;

And (b) an individual posting of each account debited and credited to include duplication and posting of labor.

(ii) Such a system cannot provide information on an expedited basis.

(iii) Such a system does not facilitate the establishment of an internal inquiry system as the journal can be controlled by only one person.

(iv) The journal becomes huge and huge.

To overcome the shortcomings of the use of the journal only as a book of original entry, the journal is subdivided into a particular journal.

The Subdivision of Journal is subdivided in such a way that a distinct book is used for each category of transactions that are repeated in nature and sufficiently large in number.

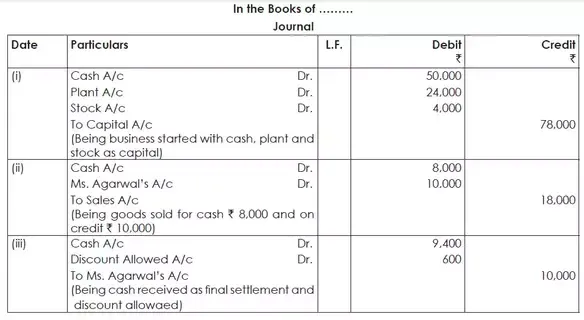

Compound Journal in Accounting:

If for a single transaction, only one account is debited and one account is credited, it is known as a Simple Journal in Accounting.

If the transaction requires more than one account which is to be debited or more than one account is to be credited, it is known as Compound Journal in Accounting.

The Compound Journal In Accounting example will make it clear :

Problem:

(i) Started business with Cash 50,000; Plant 24,000; Stock 4,000

(ii) Sold Goods for Cash 8,000 and to Ms. Agarwal for 10,000

(iii) Ms. Agarwal settled her account less discount 600

Solution:

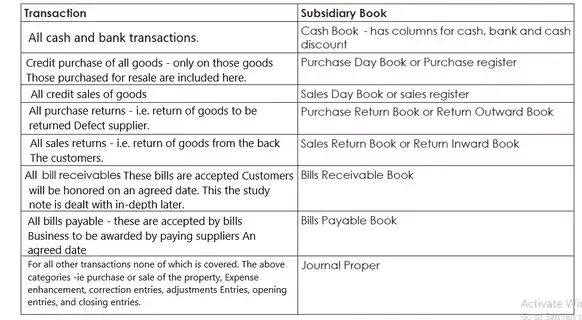

Subsidiary Books:

So, next What is Subsidiary Book in Accounting?

Although it is easy to write entries once understood, it can be difficult to manage and retrieve them if the transactions are too many.

Imagine that there are 25 purchase transactions in a day. Because the journal will record all transactions chronologically, it may be possible that purchase transactions may be scattered i.e. they cannot all come together with one after the other.

Now, at the end of the day, if the owner wants to know the total purchases made during the day, the accountant will spend time first and then collect the total to retrieve all purchase transactions from the journal. This includes time.

This is the largest limitation of the Journal, it is usually subdivided into more than one Journal. By what logic is such a subdivision formed?

This is done on the basis of similar transactions that are clubbed in a single book. Purchase transactions, sales transactions, etc. The sub-division of the journal is done as follows:

:

:Cash and bank transaction recording:

What is a Cash Book Account in Accounting?

A Cash Book Account is a special journal that is used to record all cash receipts and all cash payments.

The Cash Book Account is the original entry book because the transaction is recorded for the first time from the Source Documents.

The cash book is large in that it is designed as a cash account and records cash receipts on the debit side and cash payments on the credit side. Thus, the Cash Book Account is both a Journal and a book.

Cash Book Account only as original entry book:

The Cash Book Account records all types of transactions, even if there are some credit transactions i.e. all transactions are recorded and not like ordinary cash books where only cash transactions are recorded.

For non-cash transactions, which will be two entries in the cash book, it will ultimately have no effect on the cash balance. For example, if the goods are sold to Mr. X on a credit of Rs. 5,000, the entries will be

Types of Cash Book:

The different types of cash book are as follows:

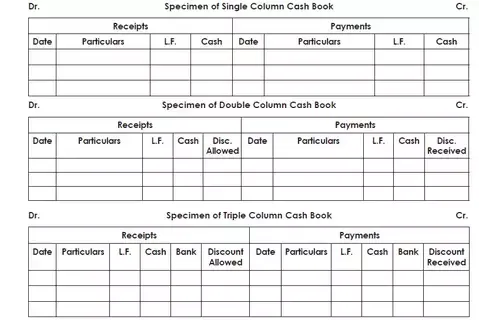

(i) Single Column Cash Book- Single column cash book has a column of one amount on each side.

All cash receipts are recorded on the debit side and all cash payments are on the payment side, this book is nothing but a cash account and there is no need to open a separate cash account in the ledger.

(ii) Double Column Cash Book - Cashbook with discount column has two amount columns, one for cash and the other for a discount on each side.

All cash receipts and cash rebates allowed are recorded on the debit side and all cash payments and rebates received are recorded on the credit side.

(iii) Triple Column Cash Book- The triple column cash book consists of three amount columns, one for cash, one for the bank, and one for discount, on each side.

All cash receipts, deposits into the bank, and discount allowed is recorded on the debit side and all cash payments, withdrawals from the bank, and discount received are recorded on the credit side.

In fact, a triple-column cash book serves the purpose of both cash accounts and bank accounts. Thus, there is no need to create these two accounts in the ledger.

cash book is a book of original entry since transactions are recorded for the first time from the source documents.

The cash book is a ledger in the sense that it is designed in the form of a Cash account and records cash receipts on the debit side and cash payments on the credit side.

Thus the cash book is both a journal and a ledger.

Double Column Cash Book containing contra transaction and cheque transaction

The Double Column Cash Book has columns on both sides of the Cash Book. This cash book can have two columns on both sides as under :

(a) Cash and Discount Columns,

(b) Cash and Bank columns,

(c) Bank and Discount columns.

(I) What is Contra Transaction?

The transaction that relates to allowing a waiver or receiving a waiver in cash after payment of the dues is known as a contra transaction.

These are the Example of Contra Entry:

1. Received 500 as a discount from Mr. Ghosh whose account was previously settled in full.

Cash A/c Dr. 500

To Discount Received A/c 500

(Being cash received as discount from Mr. Ghosh whose account was previous settled in full)

2. Paid 400 as a discount to Mr. Ghosh Dastidar who settled his account in full previously.

Discount Allowed A/c Dr. 400

To Cash A/c 400

(Being discount allowed in cash to Mr. Ghosh Dastidar who settled his account in full)

(II) Cheque Transactions:

When a cheque is received and no other information about the same is given at a later date, it will be presumed that the said cheque has already been deposited in the bank on the same day when it was received.

Then the entry should be as under:

Bank A/c Dr.

To Debtors/Party A/c

But if it is found that the said cheque has been deposited into the bank at a later date, then the entry will be:

(i) When the cheque is received

Cash A/c Dr.

To Debtors/Party A/c

(ii) When the same was deposited into the bank at a later date

Bank A/c Dr.

To Cash A/c

(iii) When the said cheque is dishonored by the bank

Debtors/Party A/c Dr.

To Bank A/c

Purchase Day Book:

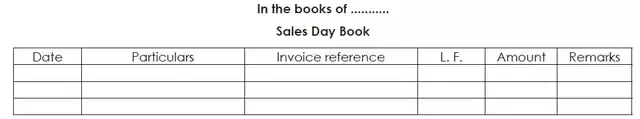

Sales Day Book:

Other Subsidiary Books – Returns Inward, Return Outward, Bills Receivable, Bills Payable.

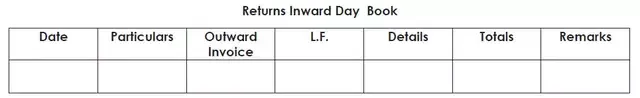

(i) Return Inward Book:

(ii) Return Outward Book:

(iii) Bill receivable book:

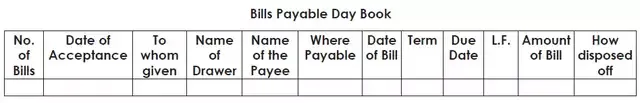

(iv) Bill payable book:

Comments

Post a Comment

If you have any doubts, Please let me know