DOUBLE ENTRY SYSTEM

In this section describing the double entry system, golden rules of accounting.

So the first question arises in our mind that what is the double entry system and its advantages?

In 1494, Luca Pacioli the Italian mathematician first published his comprehensive treatise on the principles of Double Entry System. The use of the principles of the double entry system made it possible to record not only cash but also all sorts of Mercantile transactions. It had created a clever impact on auditing too because it increases the duties of an auditor to a considerable extent.

Features of Double Entry System:

- Every activity has two-fold aspects, i.e., one party giving the benefit and the other receiving the benefit.

- Every activity is divided into two aspects, Debit and Credit. One account is to be debited and the other account is to be credited.

- Every debit side must have its corresponding and equal credit side.

These are the advantages and disadvantages of Double Entry System:

Advantages:

- The personal and impersonal accounts are kept under the double entry system, both the effects of the transactions are recorded.

- It ensures the arithmetical accuracy of the books of accounts, for every debit, there are a corresponding and equal credit. To determined by preparing a trial balance periodically or at the end of the financial year.

- Double entry system prevents and minimizes fraud. Moreover, fraud can be detected early.

- Errors can be checked and rectified easily.

- The balances of receivables and payables are ascertained easily since the personal accounts are maintained.

- The businessman can comparison the financial position of the current year with that of the past year/s.

- The businessman can justify the standing of his business in comparison with the previous year's purchase, sales, stocks, income, and expenses with that of the current year figures.

- Helps in decision making.

- The net operating results can be calculated by preparing the Trading and Profit and Loss A/c for the year ended and the financial position can be determined by the preparation of the Balance Sheet.

- It helps the Government to decide the tax.

- Double entry system helps the Government to decide the sickness of business units and extend help accordingly.

- The other stakeholders like suppliers, banks, etc make a proper decision regarding the grant of credit or loans.

Limitations or disadvantages of Double Entry System:

- The system does not disclose all the errors committed in the book's accounts.

- The trial balance maintained under this system does not disclose certain types of errors.

- It is costly as it involves the maintenance of several books of accounts.

So the next question is what is Account in accounting terms?

An Account is defined as a summarised record of transactions related to a person or a thing. e.g. when the business deals with customers and suppliers, each of the customers and suppliers will be a separate account.

We should know that each one of us is identified as a separate account by the bank when we open an account with them. The account is also related to things – both tangible and intangible. e.g. land, building, equipment, brand value, trademarks, etc. are some of the things.

When a business transaction occurs, one has to identify the account that will be affected by it and then apply the rules to decide the accounting treatment.

An account denotes a summarized record of transactions pertaining to one person, one kind of asset, or one class of income, expenses, or loss.

Classification of Accounts:

We have seen that an account may be related to a person or a thing – tangible or intangible. While doing business transactions (which may be large in number and complicated in nature), one may come across numerous accounts that are affected.

How does one determine accounting treatment for each of them? If common rules are to be applied to similar types of accounts, there must be a way to classify the account on the basis of their common characteristics.

Accounts are usually subdivided into the following classes:

1. Personal Accounts:- These accounts deal with transactions relating to persons or an organization. It can be classified as:

- Natural Persons: These persons could be natural persons like Mr. A. Adhikari, Mr. Joseph, Triveni & Sons, etc.

- Artificial Persons: The individuals could also be artificial persons like companies, bodies corporate or association of persons or partnerships, etc. Therefore, we could have like State Bank of India, ITC Ltd, CC & FC, Royal Calcutta Golf Club, etc.

- Representative Persons: There could be representative personal accounts as well. Although the individual identity of persons associated with these is known, the convention is to reflect them as collective accounts. e.g. Outstanding Expenses (representing liability for expenses to supplies); Prepaid Salary (representing employees), etc.

2. Impersonal Accounts:- There accounts do not relate to any persons are known as impersonal accounts.

- Real Accounts: These are accounts associated with assets or properties or possessions. According to their physical existence or otherwise, they are further classified as follows:-

2) Intangible Real Account – These represent possession of properties that have no physical existence but can be measured in terms of money and have a value attached to them. e.g. Goodwill A/c, Trademark A/c, Patents & Copy Rights A/c, Intellectual Property Rights A/c, and the like.

- Nominal Accounts: It is an account relating to expenses, losses, incomes, and gains. They do not have any physical existence except names. Eg: Sales, Purchases, Salary, Wages, Rent, Interest, Repairs, Travelling, etc.

What is Debit and Credit:

The Debit is obtained from the Latin word "debitum", which means 'what we will receive'. It is the destination, who enjoys the benefit.

The Credit is obtained from the Latin word "credre" which means 'what we will have to pay'. It is the source, who sacrifices for the benefit.

An account is expressed as a statement in form of the English letter T. It has two sides. The left-hand side is called the Debit side and the right-hand side is called the Credit side. The debit is connoted as Dr and the credit by Cr. Please see the following example:

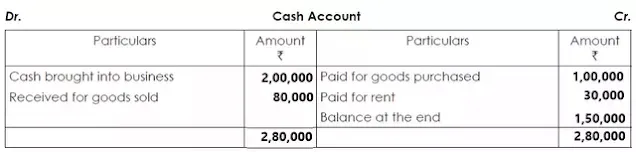

Each debit and credit side of the account will show results so that one can easily take totals of both sides and find out the difference between the two. The difference between the debit and credit sides of an account is called balance. If the total balance of the debit side is more than the balance of the credit side, then the balance is called debit balance and if the total balance of the credit side is more than the balance of the debit side, then the balance is called as a credit balance. If the debit and credit side are equal, then the account will show a nil balance.

The balances are to be computed at the end of an accounting period. These balances are then considered for the preparation of income statements and balance sheets. Let us see the example:-

Diagrammatic Representation of Accounting Rules or the Golden Rules of Accounting:

The Accounting Process:-

There are two approaches for deciding rules of debit and credit that when to write on the debit side of an account and when to write on the credit side of an account:

- American Approach/ Modern Approach

- British Approach/ Traditional Approach/Double Entry System

American Approach/ Modern Approach:

In order to understand the rules of debit and credit according to this approach, transactions are divided into the following five categories:

- Transactions relating to the owner, e.g., Capital – These are personal accounts.

- Transactions relating to other liabilities, e.g., suppliers of goods – These are mostly personal accounts.

- Transactions relating to assets, e.g., land, building, cash, bank, stock-in-trade, bills receivable – These are basically all real accounts.

- Transactions relating to expenses, e.g., salary, rent, wages, commission, cartage – These are nominal accounts.

- Transactions relating to revenues, e.g., interest received, dividend received, sale of goods – These are nominal accounts.

The rules of debit and credit in relation to these accounts are stated as under:

Rules of debit and credit for Capital Account:

Debit side means a decrease

Credit side means an increase

Rules of debit and credit For any Liability Account:

Debit side means a decrease

Credit side means an increase

Rules of debit and credit For any Asset Account:

Debit side means an increase

Credit side means a decrease

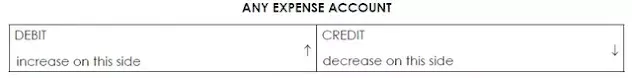

Rules of debit and credit For any Expense Account:

Debit side means an increase

Credit side means a decrease

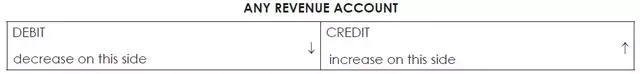

Rules of debit and credit For any Revenue Account:

Debit side means a decrease

Credit side means an increase

A careful perusal of the above rules of debit and credit will reveal that meaning of debit is the same for the first three types of accounts on the one side and the last two types of accounts on the other. It also reveals that in the first three cases debit stands for decrease, and for an increase in the last two cases. Similarly, credit stands for an increase in the first three cases and for the decrease in the last two cases. The rules of debit and credit have been diagrammatically illustrated as under:

British Approach/ Traditional Approach/Double Entry System :

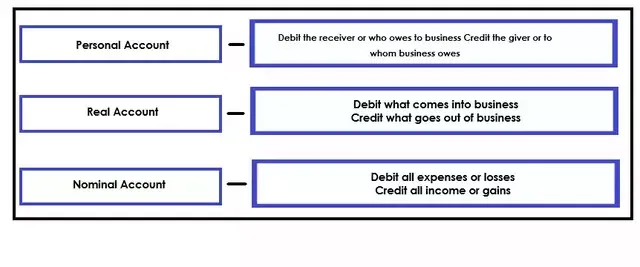

When one identifies the account that is getting affected by a transaction and the type of that account, the next step is to apply the rules of debit and credit to decide whether the accounting is to debit or credit that account.

The golden rules of accounting will guide us whether the account is to be debited or credited. There is one rule for each primary type of account i.e. personal, real, and nominal. The rules of debit and credit of the following account are shown in the chart.

There are 3 golden rules of accounting:

Traditional version:

Events: Any or all activities which we are doing in our day-to-day life. Example: Reading, Sleeping, Eating, Thinking, Singing, Gossiping, Buying, Selling, Playing, and etc.

Transactions: An event which has the following characteristics:

- Which changes the financial position of a person.

- Which can be measured in terms of money.

- which can be recorded in the Books of Accounts.

Example: Purchase, Sales, Travelling Expenses, Rent, Wages, Salaries, and etc. It is, therefore, concluded the All transactions are events but all events are not transactions.

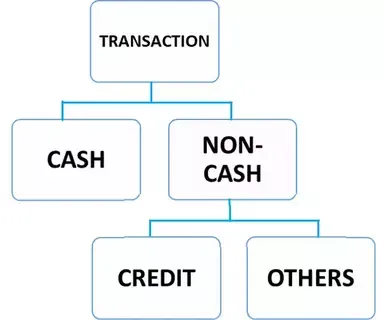

Classification of Transaction:

Cash Transactions: Those transactions which involve inflow/outflow of cash.

Example: a) Purchased goods for cash Rs. 100.

b) Paid expenses Rs. 20.

c) Sold goods for cash Rs. 300 and etc.

Non-cash Transaction: Those transactions which are not involved with immediate inflow/outflow of cash. They are again sub-divided costs.

Credit Transactions: Those transactions which involve an increase in assets/liabilities.

Examples: a) Goods sold to Mr. Dev on credit

--- increase in assets.

b) Purchased goods from Sunny on credit

--- increase in liability.

Non-Cash Transactions: Those which involve losses and does not result in an immediate outflow of cash.

Example: a) Depreciation of Fixed assets,

b) Bad Debts and etc.

Accounting Voucher System:

A voucher is a written instrument that serves to confirm or witness (vouch) for some facts such as a transaction. Commonly, a voucher is a document that reveals goods have bought or services have been rendered, authorizes payment, and indicates the ledger account(s) in which these transactions have to be recorded.

What are the types of accounting vouchers? Normally the following types of vouchers are used. i.e.:

- Receipt Voucher

- Payment Voucher

- Non-Cash or Transfer Voucher

- Supporting Voucher

Receipt Voucher:

It is used to record money or bank receipt. Receipt vouchers are of two types. i.e.

Cash receipt voucher – it denotes receipt of money.

Bank receipt voucher – it signifies receipt of cheque or demand draft

Payment Voucher:

It is used to record a payment of money or cheque. Payment vouchers are of two types. i.e.

Cash Payment voucher – it denotes payment of money.

Bank Payment voucher – it signifies payment by cheque or demand draft.

Non-Cash Or Transfer Voucher:

These vouchers are used for non-cash transactions as documentary proof. e.g., Goods sent on credit.

Supporting Vouchers:

These vouchers are the documentary proof of transactions that have happened.

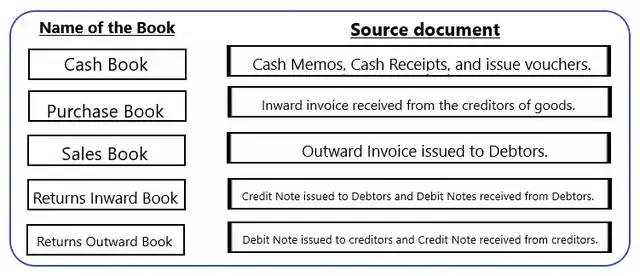

Source Documents

Vouchers are the documentary evidence of the transactions so happened. Source documents are the base on which transactions are recorded in subsidiary books i.e. source documents are the evidence and proof of transactions.

What is the Accounting Equation with an example?

The whole Financial Accounting depends on Accounting Equation which is also known as the Balance Sheet Equation. The basic Accounting Equation is:

Assets = Liabilities + Owner’s equity

or A = L + P

or P = A - L } Where P = Capital, A = Assets, L = Liabilities,

or L = A - P

While trying to do this correlation, please note that incomes or gains will increase the owner’s equity, and expenses or losses will reduce it.

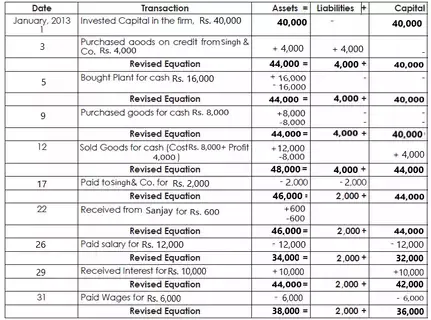

Accounting Equation examples:

Let see how to prepared Accounting Equation from the following transactions in the books of Mr. Dev for January 2015 :

1 Invested Capital in the firm 40,000

3 Purchased goods on credit from Singh & Co. for 4,000

5 Bought plant for cash 16,000

9 Purchased goods for cash 8,000

12 Sold goods for cash (cost 8,000 + Profit 4,000) 12,000.

17 Paid to Singh & Co. in cash 2,000

22 Received from Sanjay 600 (being a debtor)

26 Paid salary 12,000

29 Received interest 10,000

31 Paid wages 6,000

Solution:

Effect of the transaction on Assets, Liabilities, and Capital

Comments

Post a Comment

If you have any doubts, Please let me know