Examples relating to the Double Entry System & Golden Rules of Accounting :

Illustrations 1:

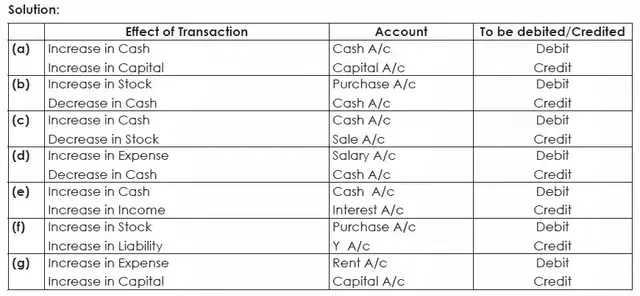

Determined the debit and credit from the following particulars Under the American Approach/ Modern Approach:

- The business started with capital.

- Bought goods for cash.

- Sold goods for cash.

- Paid salary.

- Received Interest on Investment.

- Bought goods on credit from Mr. Y

- Paid Rent out of Personal cash.

Illustrations 2:

Determined the debit and credit from the following particulars Under the British Approach/ Traditional Approach/Double Entry System (golden rules of accounting):-

We will see the following example to understand the application of the rules of debit and credit. Consider the following transactions:

1.Mr. Shanker and Mrs. Aditi who are husband and wife started offering consultancy services, by investing cash of Rs. 5,00,000 and Rs. 2,50,000 respectively.

Solution:- From a business point of view, the two effects of this transaction are: first, the cash of Rs.7,50,000 has come into the business, and second, there is an obligation of the business towards Mr. Shanker and Mrs. Aditi.

- Read Also: Accounting Inventory |Net realisable value

- Read Also: Accounting Journal| Cash Book| Its Types

Now, we know that Cash is a real account, so the rule for a real account will apply. As per the golden rules of accounting, Cash has entered into the business thereby increasing the asset. Hence, the Cash Account should be debited.

We also know that Shanker’s A/c and Aditi’s A/c are personal accounts, so the rule for a personal account will apply. (As both Shanker and Aditi are givers of cash, their respective accounts will be credited.)

The answer will be:- Debit Cash 7,50,000

Credit Shanker’s Capital 5,00,000

Credit Aditii’s capital 2,50,000

The total debit side and total credit side match. It is the reflection of the dual aspect concept

2. Both of them buy office furniture of Rs. 25,000 for cash.

Solution:- Here, the two effects are: First, Furniture (which is an asset) has entered into the business, and second cash (which is also an asset) that has gone out of business.

Since, both the accounts viz. Furniture and Cash are real accounts, the rule for a real account will apply. As per the golden rules of accounting, Furniture has entered in (asset increase), it will be debited and cash has gone out (asset decrease), it will be credited.

The answer will be:- Debit Furniture 25,000

Credit Cash 25,000

3. They open a current account with Citi Bank by depositing Rs.1,00,000.

Solution:- Here, the two effects are: As per the golden rules of accounting, cash in hand has gone out (asset decrease), and the business cash at bank has increased (asset increase). Cash is a real account and the Bank is a personal account.

The answer will be:- Debit Citi Bank 1,00,000

Credit Cash 1,00,000

4.They pay office rent of Rs.15,000 for the month by cheque drawn on their Citi Bank to M/s Realtors Properties.

Solution:- Here, the two effects are: As per the golden rules of accounting, since the payment is made by cheque, bank balance will reduce (asset decrease), and the rent being a part of expense rent expense will increase.

Citi Bank A/c being a personal A/c, the rule for a personal account will apply. Citi bank A/c will be credited.

Rent A/c being a nominal account, the rule for the nominal account will apply. Since rent is paid, it is an expense. Hence, Rent A/c will be debited.

The answer will be:- Debit Rent 15,000

Credit Citi Bank 15,000

In case of a cash transaction, the party with whom the transaction is made is not recorded, but the cash or bank account is recorded.

5.They buy a motor car worth Rs.4,50,000 from Generation Motors by making a down payment of Rs.50,000 by cheque drawn on Citi Bank and the balance by taking a loan from HDFC Bank.

Solution:- Here the effects will be: As per the golden rules of accounting, Motor Car (which is an asset) has come into the business (increase in asset). And the Bank balance (that is an asset) has reduced (decrease in asset). There is an obligation created towards HDFC Bank from whom a loan of Rs. 4,00,000 is taken (increase in liability).

Citi Bank is a personal account, so rules for personal accounts will apply. Citi Bank will be credited.

Motor Car is a real account is so the rule for a real account will apply. Motor Car has entered, so Motor Car A/c will be debited.

HDFC Bank is a provider of loans to whom money is payable by the business in the future.

HDFC Bank account being a personal account, the rule for a personal account will apply.

HDFC Bank being the giver, it will be credited. (Note: From a different point of view, we can consider Citi Bank A/c as Real Account. The reason behind that is the balance at Citi Bank A/c belongs to the business, so it is an asset. However, in any circumstances, HDFC Bank, who has paid Generation Motors on behalf of the business, cannot be considered as Real Account. It is a Personal Account as it does not carry any business cash)

The answer will be:- Debit Motor Car 4,50,000

Credit Citi Bank 50,000

Credit Loan from HDFC Bank 4,00,000

6. Shanker and Aditi carried out a consulting assignment for Avon Pharmaceuticals and raise a bill for Rs.10,00,000 as consultancy fees. Avon Pharmaceuticals have immediately settled Rs.2,50,000 by way of cheque and the balance will be paid after 30 days. The cheque received is deposited into Citi Bank.

Solution:- Here the effects will be: First, the work done by Shanker and Aditi has resulted in the revenue for the business.

What should be the amount of revenue considered? Is it Rs.10 lakh for which work is done or only Rs.2.50 lakh which is considered?

The revenue of the entire Rs.10 lakh will be considered as by doing the work the business has acquired a legal claim against Avon Pharmaceutical.

The second effect will be cash that is received by way of cheque (asset increase).

The third effect will be the amount of Rs.7.50 lakh, which Avon Pharmaceuticals owes to the business.

Consultancy fees received (revenue earned) being income, the rule for a nominal account will apply and this account will be credited.

Cheque received and deposited into Citi bank will increase the balance at the bank. Citi Bank is a personal account that will be debited.

The amount receivable from Avon is an asset, but it’s due from Avon at a future date. To be able to recover it from them, their personal account will have to be created in books of accounts.

Avon Pharmaceuticals is a personal account and they are receivers of consultancy, it will be debited.

The answer will be:- Debit Citi Bank 2,50,000

Debit Avon Pharmaceuticals 7,50,000

Credit Consultancy Fees 10,00,000

7. They have employed a receptionist on a salary of Rs.5,000 per month and one officer at a salary Rs.10,000 per month. The salary for the current month is payable to them.

Solution:- Is this a transaction to be recorded in the books? Remember the accrual concept?

Accordingly, the expense of salary for the current month must be recognized as the expense for the current month even if it’s not paid for. In fact, the business owes the salary to its employees and this obligation (which is a liability) must be shown in the books.

The effects will be: First, salary being an item of expense, is a nominal account, and rule for a nominal account will be applied. So, Salary A/c will be debited.

Secondly, the obligation to pay salary is towards both employees, the convention is not to create separate employee accounts, but to use a representative personal account named as Salary Payable account.

Since, this is a personal account, the rule of personal account will apply. Employees being givers of service, it will be credited.

The answer will be:- Debit Salary 15,000

Credit Salary payable 15,000

Please look at the way we have approached each transaction and decided about accounting treatment. If you follow these logical steps, you will certainly be able to grasp the basics thoroughly.

Under the double entry system, the accounting of a business transaction involves the following steps:

(a) Determine whether an event qualifies to be entered in books of accounts in money terms.

(b) If the answer to the above is yes, then evaluate the two aspects of the transaction.

(c) Consider what type of ‘account’ is affected by each of the aspects.

(d) Use the golden rules of accounting of Debit and Credit.

(e) Create the basic document such as invoice, voucher, debit note, or credit note.

(f) Documentation of the transaction in the primary books or subsidiary books.

(g) Carry out the posting into the ledger.

(h) Create the list of all ledger balances and ensure it tallies.

(i) Rectify the errors, if any

(j) Pass adjustment entries.

(k) Create Adjusted Trial Balance.

(l) Create the financial statements – the Income Statement and Balance Sheet.

Although it looks to be a lengthy process on paper, in practice it does not take time. In a computerized accounting environment in fact one has to prepare basic documents and enter them into the accounting programs.

The computer program automatically carries out the rest of the processes to give us real-time online financial statements. To get a hang of this, students are advised to lay their hands on simple computerized accounting packages to gain real-time exposure.

Illustrations 3:

Determine the Debit and Credit under the British Approach or Double Entry System (golden rules of accounting). Take Previous illustration 1:-

Illustrations 4:

Classify the following under personal, real, nominal accounts. Also state whether it recorded assets, liability, expense, loss or revenue:

Comments

Post a Comment

If you have any doubts, Please let me know