Accrual Basis Accounting and Cash Basis of Accounting:

What is the Accrual Basis of Accounting:

The Accrual Basis of Accounting is a manner of recording transactions by which revenue, costs, assets, and liabilities are reflected in the accounts for the period in which they accrue.

This basis includes consideration relating to deferrals, allocations, depreciation, and amortization.

This Accrual Basis of Accounting is also referred to as a mercantile basis of accounting.

Under the Companies Act 1956, all companies need to maintain the books of accounts according to the accrual basis of accounting.

What is the Cash Basis of Accounting:

The Cash Basis of Accounting is a manner of recording transactions by which revenues, costs, assets, and liabilities are reflected in the accounts for the period in which actual receipts or actual payments are made.

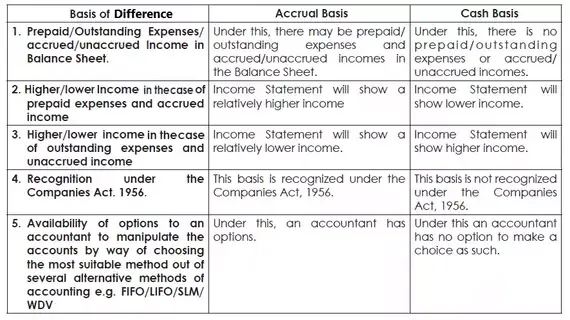

The distinction between Accrual Basis of Accounting and Cash Basis of Accounting.

The accrual basis of accounting differs from the cash basis of accounting in the following respects:

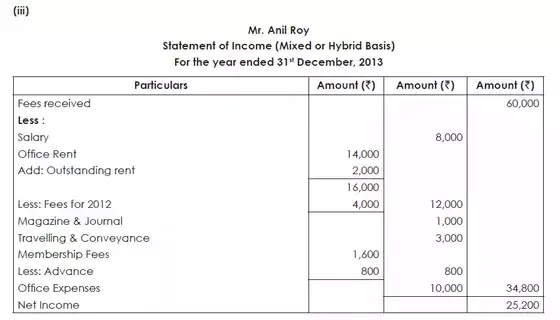

Hybrid or Mixed Basis:

Incomes are recorded on a Cash basis but expenses are recorded on an Accrual Basis of Accounting.

It is a mixture of the Cash Basis Accounting and Accrual Basis Accounting. This system is based on the concept of conservatism.

Under the hybrid system of accounting, incomes are recognized as in Cash Basis Accounting i.e. when they are received in cash, and expenses are recognized on an Accrual Basis of Accounting i.e. during the accounting period in which they arise despite when they are paid.

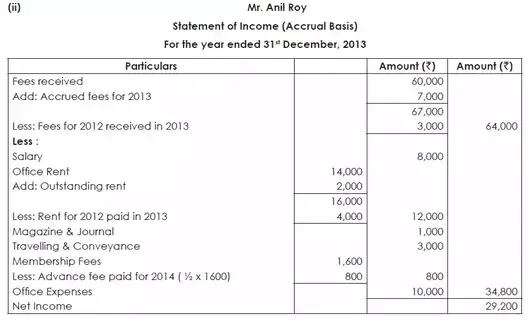

Illustration 1:

Mr.Anil Roy, a junior lawyer, provides the following particulars for the year ended 31st December 2013:

- Fees received in cash in 2013 60,000

- Salary paid to Staff in 2013 8,000

- Rent of office in 2013 14,000

- Magazine and Journal for 2013 1,000

- Travelling and Conveyance paid in 2013 3,000

- Membership Fees paid in 2013 1,600

- Office Expenses paid in 2013 10,000

Additional Information:-

Fees include 3,000 in respect of 2012 and fees not yet received are 7,000.

Office rent includes 4,000 for the previous year and rent of 2,000 not yet paid.

Membership fees are paid for 2 years.

Compute his net income for the year 2013, under – (i) Cash Basis, (ii) Accrual Basis, and (iii) Mixed or Hybrid Basis.

The Conversion of Cash Basis of Accounting into the Accrual Basis of Accounting:

When accounting is done under the Cash Basis of Accounting and the final accounts are prepared, the same can be converted into an Accrual Basis of Accounting from the beginning of the next financial period. The following method should be followed for the purpose.

At first, it is necessary to ascertain the amount of outstanding and prepaid expenses and at the same time, accrued incomes and income received in advance.

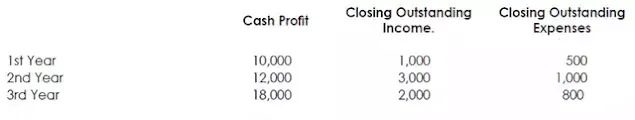

Illustration 2:

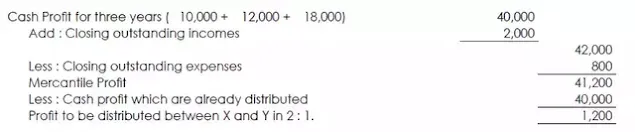

X and Y formed partnership sharing profits as 2: 1. The term was to distribute mercantile profit. But cash profit has been calculated all through. Now it is requested to convert cash accounts into mercantile accounts. The details are :

Pass conversion entry.

Solution:-

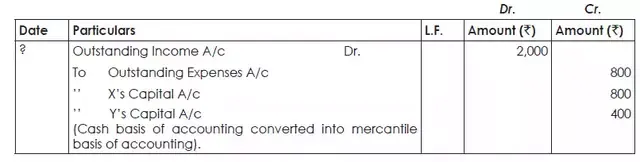

Thus, the entry being:-

Journal

Comments

Post a Comment

If you have any doubts, Please let me know