General Ledger

Ledger is the main book or principle book of the account. The entries in the ledger pass through the path of the journal and subsidiary books.

The ledger includes all accounts viz. Assets, Liabilities, Income or Profit, Expense or Loss, Owner's Capital, and Owner's Equity. The ledger is the book of the final entry and is therefore a permanent record.

A systematic way in which transactions are posted in a ledger. Once the transaction is posted for an accounting period, the ledger accounts are balanced (i.e. the difference between the debit side and the credit side is calculated).

These balances are eventually used to prepare financial statements such as profit and loss A / C and balance sheets.

The ledger can also be divided into general ledgers and sub-ledgers.

While all ledgers in General Ledger will be ledger accounts, the sub-Leaders will have individual accounts of customers and suppliers.

If there are 15 parties, the general ledger will not have 15 individual accounts for each party.

Instead, these 15 party's accounts will exist under the name Receivables or debtors ledger and the general ledger will have only one account representing the customers.

It is named the Debtors Control Account. The same is true of supplier accounts. Such sub-leaders are essential for better control over personal accounts.

Also, it will protect the general ledger from becoming too large, especially when the number of customers and suppliers is large.

How to prepare a ledger account?

J.F.= Journal Folio

Process of Ledger Posting:

As and when a transaction occurs, it is entered into the journal as a journal entry.

This entry is then posted from the journal to the corresponding ledger under the double-entry principle. This is called ledger posting.

Each ledger account has two identical parts:

-- debit side -- on the left-hand side and

-- credit side -- on the right-hand side.

What are the three golden rules of accounting to record transactions?

- Debit the receiver and Credit the giver.

- Debit what comes in and Credit what goes out.

- Debit all expenses and losses and credit all incomes and gains.

What are the 5 types of accounts and how do you write a ledger of various types of Accounts?

These are the accounts and their rules :

Assets: Increase on the left side or debit side and decrease on the credit side or right side.

Liabilities: Increases the credit side and decreases the debit side.

Capitals: Similar to liabilities.

Expense: Increases the debit side and decreases the credit side.

Income or Profit: Increases on the credit side and decreases on the debit side.

To summarise:

The student must clearly understand the nature of Debit and Credit.

A debit denotes:

(A) In the case of a person against whom he has received some benefit against whom he has already rendered some service or will render service in the future.

When a person becomes liable to do something in favor of the firm, the fact is recorded by debiting the person's account: (related to the personal account)

(B) In the case of goods or assets, the value and stock of such goods or assets have increased, (relating to Real accounts)

(c) In the case of other accounts, such as losses or expenses, that the firm has incurred some expenses or lost money. (Related to nominal account)

A credit indicates:

(A) In the case of a person, that some profit has been received from him, which gives him the right to claim the return benefit in the form of cash or goods or service from the firm.

When a person becomes entitled to money or money for any reason. Facts are recorded by depositing him (related to personal account)

(b) In the case of goods or properties, that the stock and value of such goods or properties are depleted. (Related to real accounts)

(C) In the case of other accounts such as interest or dividend or commission received or discounted, that the firm has made a profit (related to nominal account).

At a glance:

How the Ledger is Posting:

As and when the transaction takes place, it is recorded in the journal in the form of a

journal entry. This entry is posted again in the respective ledger accounts under the

double-entry principle from the journal. This is called

ledger posting.

Let us now understand the mechanism of posting transactions in a ledger account. The transaction is: Rent paid in cash for 10,000. The journal entry for this transaction will be:

Jan 15 Rent A/c Dr. 10,000

To, Cash A/c 10,000

We will open two ledger accounts named Rent A / C and Cash A / C. Let us see how posting is done.

While posting the transaction in the ledger, please observe the following conventions. Note that both effects of entry must be recorded in the ledger simultaneously.

(1) The posting in the account where debited is done on the debit side by writing the name of the party or accounts credited with the prefix 'to'.

(2) The post in which the account is credited is done on the credit side by writing the name of the account or accounts which are debited with the prefix 'By'.

Balancing of an account:

What is done is that after posting all the transactions in these accounts, the difference between the debit and credit sides is calculated. This difference is favored with small amounts for the grand totals on both sides. The convention is to write "to balance C / D" or "by balance C / D" as the case may be. This process is usually done at the end of an accounting period. This process is called the "balance of ledger accounts".

If the debit side total is greater than the credit side total of the same ledger account, the balance is known as the debit balance.

If the credit side total is greater than the debit side total of the same ledger account, the balance is known as the credit balance.

A debit balance shows that :

- Money is owing to the firm. (Personal Account)

- The firm owns property or goods. (Real Account)

- The firm has lost money or increased certain expenses. (Nominal Account)

A debit balance is shown on the credit side as By Balance carried down or By balance c/d.

A credit balance shows that:

- Money is owing to some person (Personal Account).

- The firm has given up so much property. (Real Account).

- The firm has earned an income or gains. (Nominal Account).

A credit balance is shown on the debit side as To Balance carried down or To Balance c/d.

Once the account holders are balanced for an accounting period, the balance should be carried forward as the balance in the current account. This is done by typing "to balance B / D" or "by balance B / D", as may be the case after grand totals.

Can you now try to balance the other ledger and move the balance to the next accounting period?

Important note: Please remember that personal and real account balances are carried over to the next accounting period only because they represent the resources and obligations of the business that will continue to be used and settled respectively in the future.

The balances of nominal accounts (which represent income or profit and expense or loss) are not carried over to the next period.

These are taken into profit and loss account (or income statement) prepared for the remaining period.

The net result of a P&L account would show either net income or net loss that would increase or decrease the owner's equity.

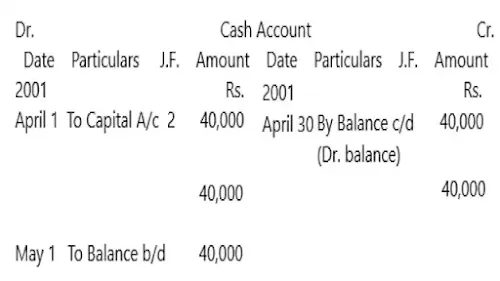

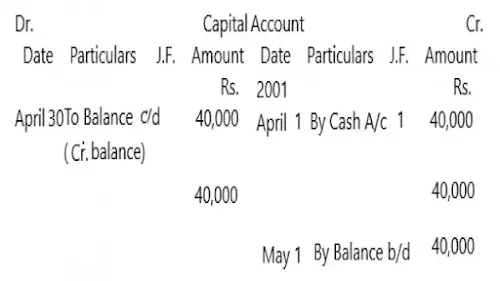

With reference to the previous illustration, let us show the ledger balancing at the end of the month:

In the above cash account, the debit side total is Rs. 40,000 while the credit side total is NIL. So, the debit side is Rs. 40,000 more than the credit side total. This balance is placed on the credit side as By Balance c/d, Again the balance is brought down at the beginning of the next accounting period as To Balance b/d.

In the above Capital Account, the credit side total is Rs. 40,000 and the debit side total is NIL. So the credit side total is Rs.40,000 more than the debit side total. This balance is placed on the debit side as To Balance c/d, again the balance is brought down at the beginning of the next accounting period as By Balance b/d.

Typical ledger account balance

We have seen how to balance the different ledgers. It can be seen that while some accounts will show a debit balance, the other will show a credit balance.

Is there a relationship between the type of account (whether it is an account of an asset, liability, capital, owner's equity, income or profit, expense, or loss) and that kind of balance (debit or credit)?

The answer is usually 'yes. You can test to find the following relationships.

Type of Account Type of balance

All asset accounts Debit balance

All liability accounts Credit balance

Capital & Owner’s equity account Credit balance

Expenses or loss accounts Debit balance

Incomes or gain accounts Credit balance

Let us test these possibilities for confirmation. How is this test known? Consider Cash A / C.

We debit it whenever the business receives cash, and we credit it whenever it is paid. Is it possible to see that the credit of cash is more than debit? In other words, can we have negative cash?

Therefore cash account will always show a debit balance. So is true for all real property accounts.

After solving the problems, if the opposite is seen, then there is every possibility that an error has occurred while passing the accounting entries.

The Structure of Ledger

In practice, for convenience and ease of operation, the following are divided as follows:

A) General Ledger: This includes all the main ledger accounts except the personal accounts of customers, vendors, and employees.

There will be only one representative account in the general ledger for these categories.

For customers - Trade Debtors A / C (or Trade Receivables Control A / C),

For suppliers - Trade Creditors A / C (or Trade Payables A / C) etc.

B) Sub-ledgers: These are mainly customer ledgers, supplier ledgers, employee ledgers, etc. The customer's account will have all the individual accounts of all customers.

The suppliers' ledger will contain all the individual accounts of all suppliers. The employee account holder will have individual accounts of all employees.

The balance of all individual accounts should be in the general ledger with the balance reflected in the representative A / C. For this, reconciliation is necessary from time to time.

For example, if the business has 3 customers A, B, and C; Then an A / C for each of them is opened in the sub-ledger called Customers Ledger and General Ledger will have only one A/c by the name of that Trade Debtors A/c.

All transactions with each of them will be recorded in the individual accounts as well as the control ledger. See the following:

Such isolation is done for better control. The person in charge of customer accounting is given the responsibility of all individual customer accounting in the customer sub-ledger, while another person is given the responsibility of the supplier sub-ledger.

This division of labor is an absolute necessity in large organizations. The person taking care of the general leader is different.

Simultaneous posting of transactions in sub-ledgers A / Cs and representative A / Cs in the general ledger can be quite tedious in manual accounting. But computerized accounting also automates this process.

Subdivisions of Ledger

Practically, the Ledger may be divided into two groups -

(a) Personal Ledger & (b) Impersonal Ledger. They are again sub-divided as :

Personal Ledger: The ledger where the details of all transactions are recorded in relation to the persons belonging to the accounting unit is called Personal Ledger.

Impersonal Ledger: The ledger where details of all transactions about assets, income, and expenses, etc. are recorded, called the Impersonal Ledger.

Again, Personal Ledger can be divided into two groups:

Viz. (A) Debtors' ledger, and (B) Creditors' ledger.

(A) Debtors' Ledger: The ledger where details of transactions are made about the persons for whom goods are sold, cash is received, etc., are called debtors' ledger.

(B) Creditors' Ledger: The ledger where details of transactions are made about the persons from whom goods are purchased on credit, paid to them, etc. are recorded, It is said creditors' ledger.

The impersonal ledger can, again, be divided into two groups, namely (A) cash book; And (B) General Ledger.

(A) Cash Book: The book where all cash and bank transactions are recorded is called the cash book.

(B) General Ledger: A ledger where details of real accounts, all transactions relating to nominal accounts, details of Debtors’ Ledger, and Creditors' Ledger are recorded is called a general ledger.

General Ledger, again, can be divided into two groups. Viz, nominal ledger, And private ledger.

(A) Nominal Ledger: The ledger where all transactions related to income and expenditure are recorded is called the nominal ledger.

(B) Private Ledger: The ledger where all transactions related to assets and liabilities are recorded is called the private ledger.

The advantages of sub-division of the ledger are:

(A) Easy to divide work: As a result of sub-division, division of work is possible and records can be maintained efficiently to the employee concerned.

(B) Easy to handle: As a result of sub-division, ledger size and volume are reduced.

(C) Easy to collect information: A particular type of transaction can be easily detected from different classes of ledgers.

(D) Reducing mistakes: As a result of sub-division, the chances of mistakes are minimized.

(E) Easy to calculate: As a result of sub-division, accounting work can be calculated quickly which is very helpful for management.

(F) Determination of responsibility: Due to sub-division, different types of tasks are allocated to different employees, for which the concerned employees will be responsible.

Some terms used:

Casting -- totaling

Balancing -- to find the difference between the debit side total and credit side of an account.

C/d -- Carried down

B/d -- Brought down

C/o -- Carried over

B/o -- Brought over

C/f -- Carried forward

B/f -- Brought forward

Comments

Post a Comment

If you have any doubts, Please let me know